Seams

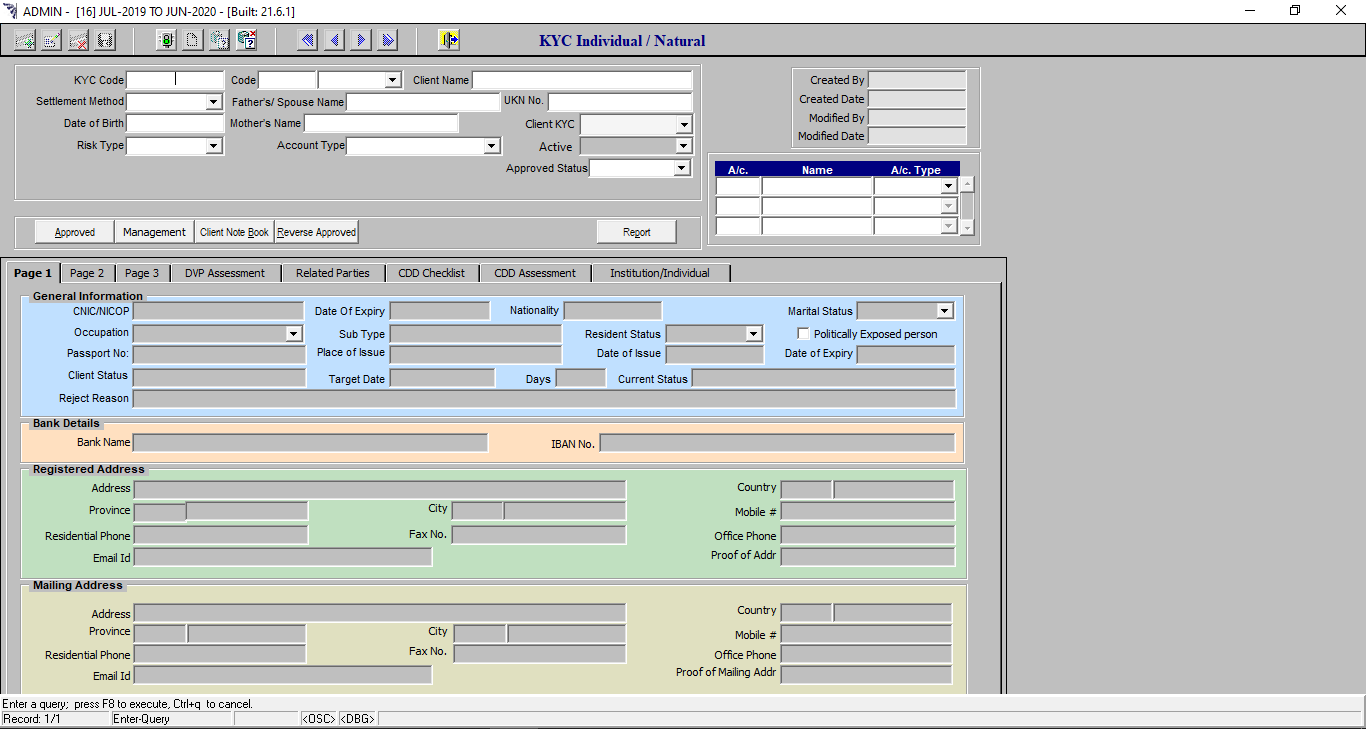

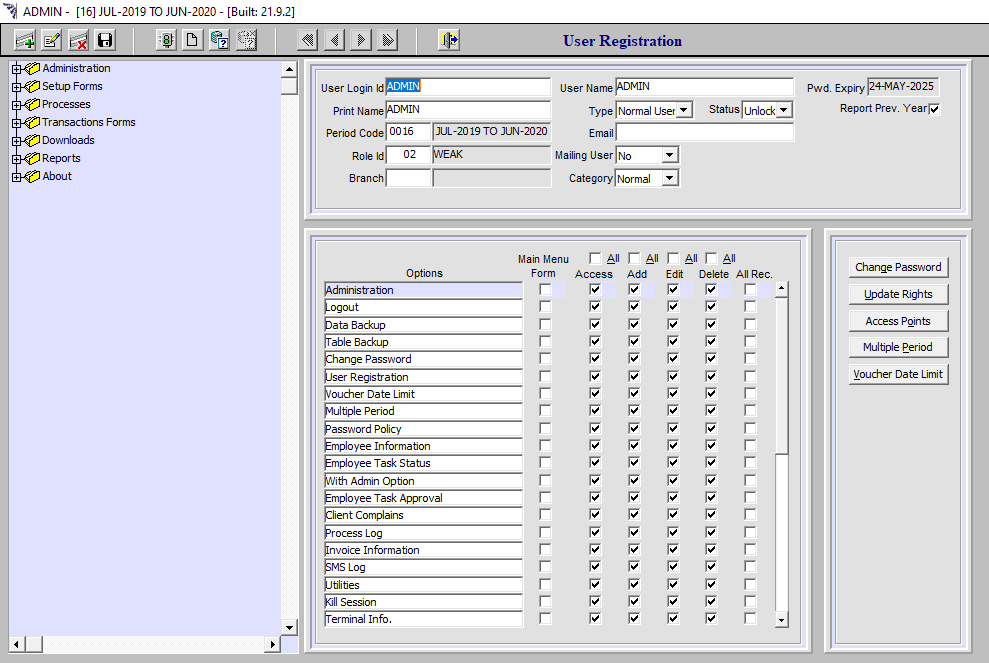

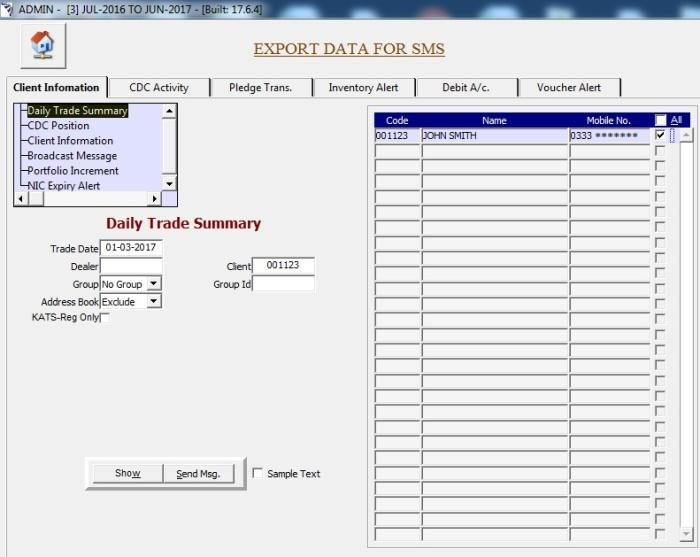

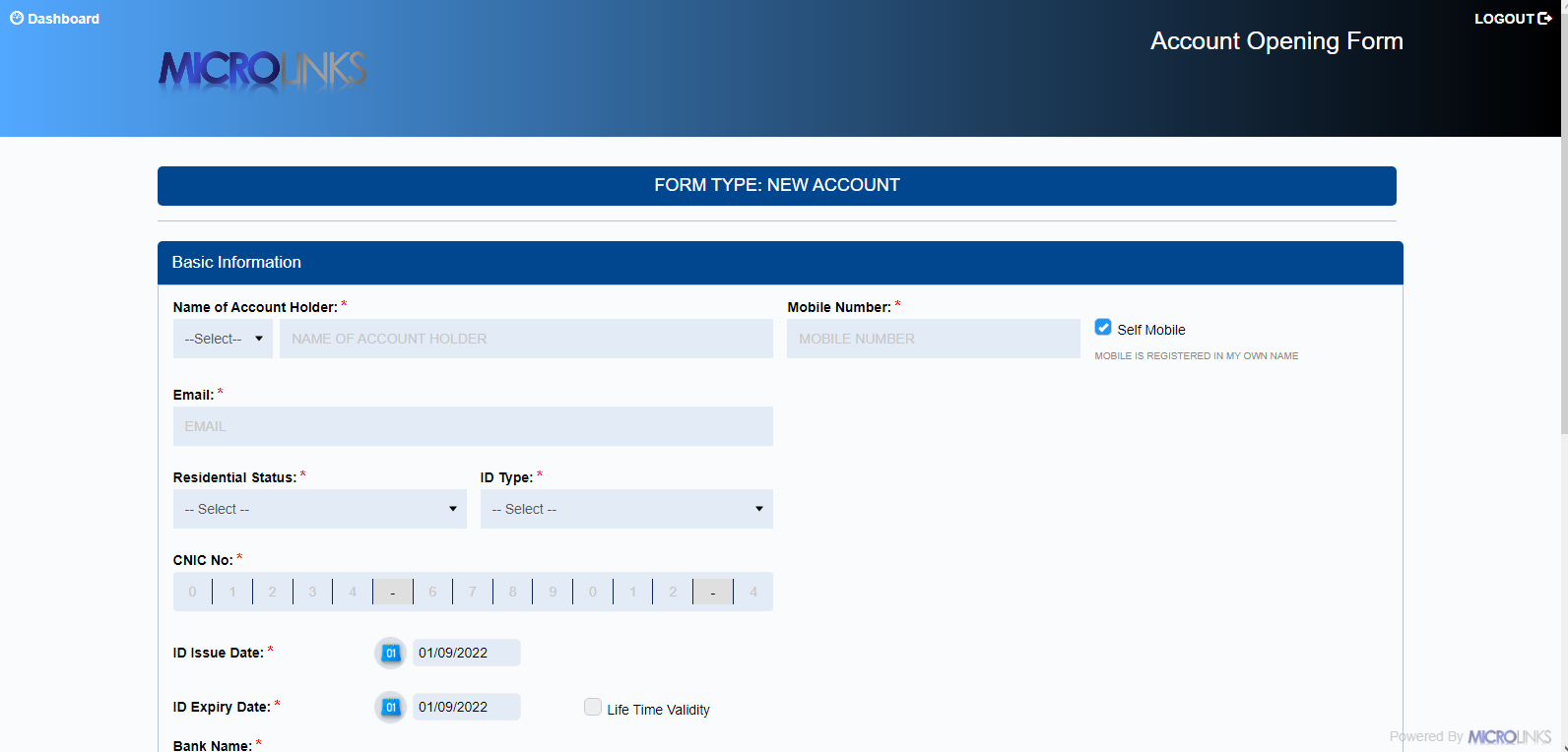

Seams is an ERP back-office solution for equity brokerage companies with integrated custody, settlement, Human Resource, Payroll and GL system.

Power Features

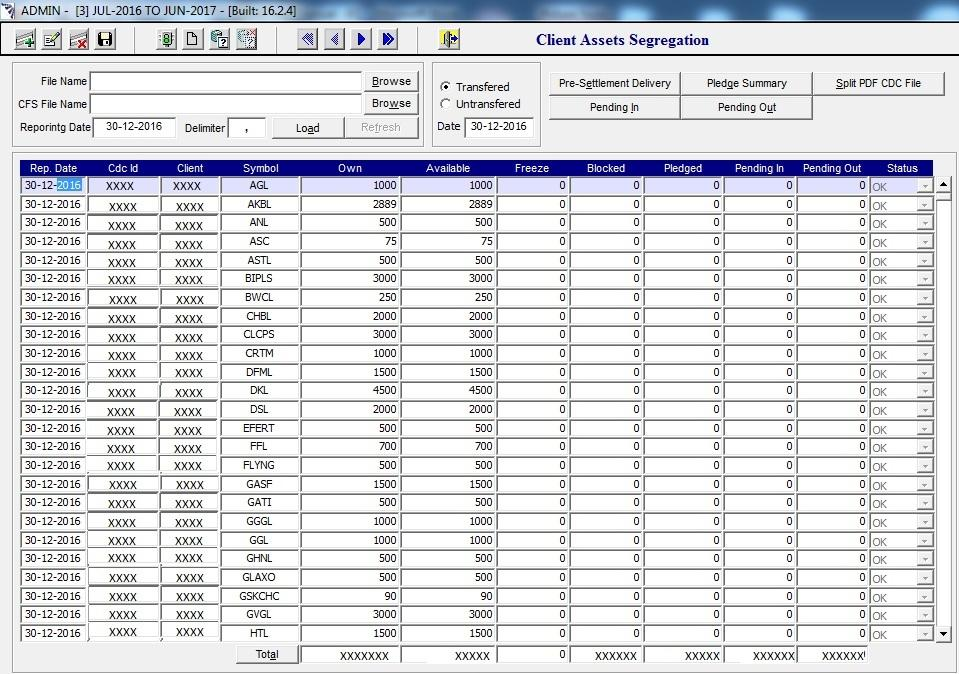

- Custody

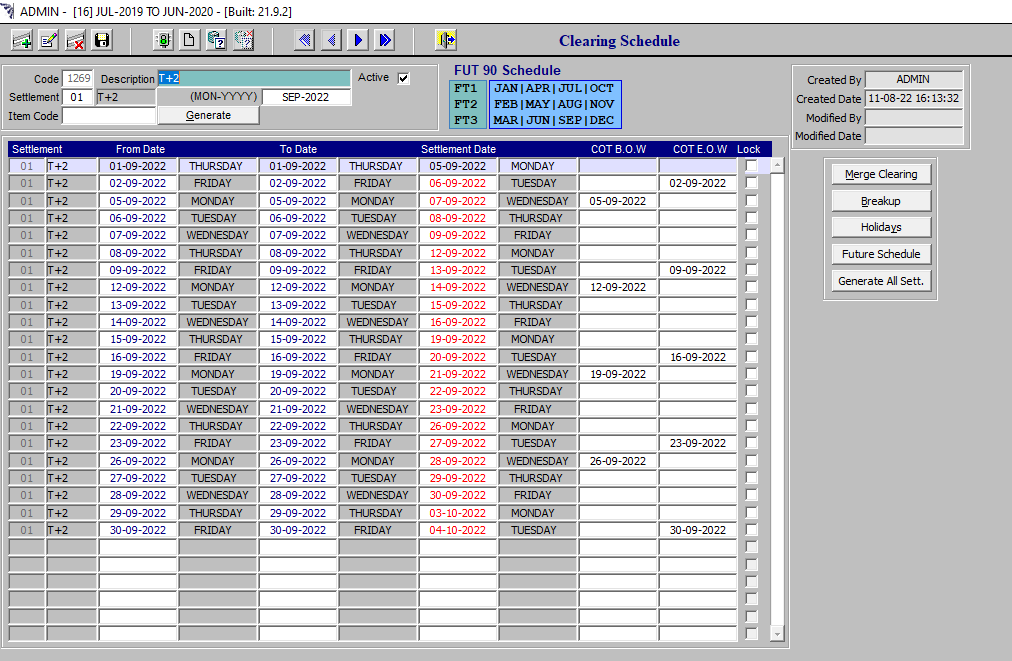

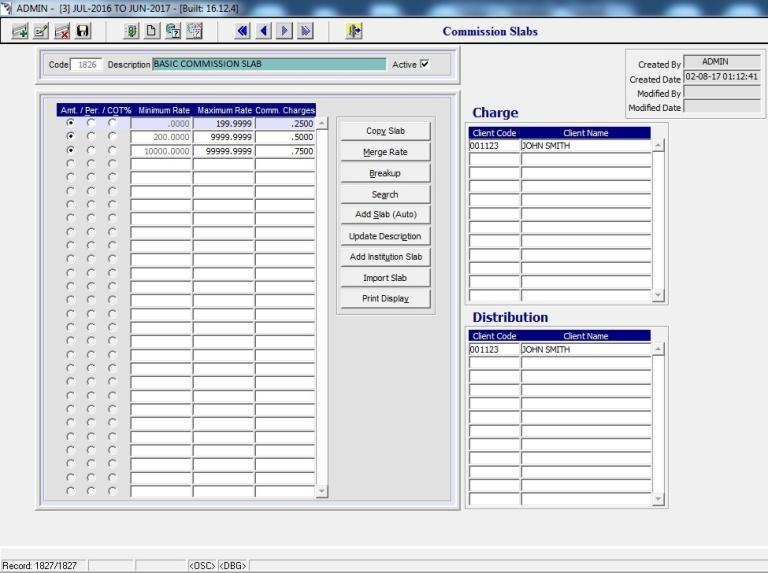

- Settlement

- Human Resource

- Payroll

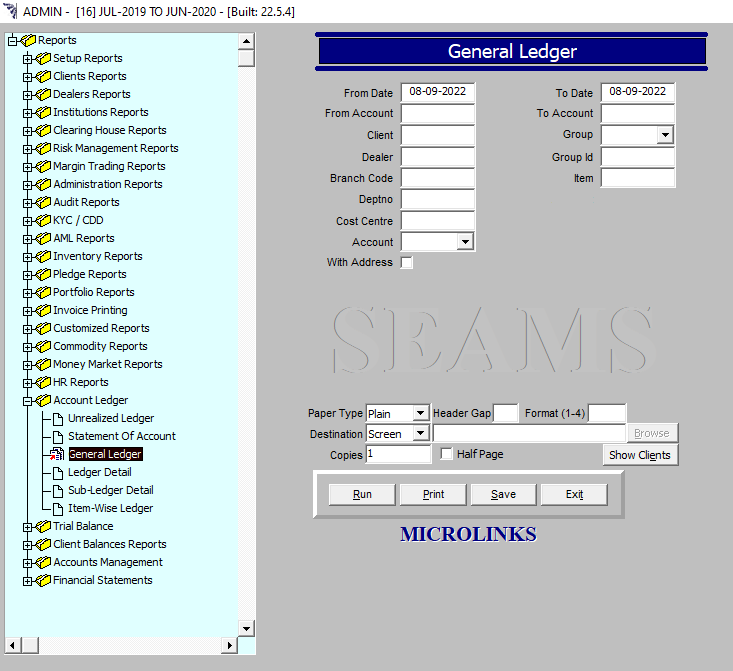

- GL system